FL, USA, 22 July 2024-Elections are often major game changers for FX markets. The differences in fiscal policies between political parties, campaign promises, thoughts on central bank independence, risk of sharp policy changes, and foreign policy changes are some of the reasons that the forex market often sees heightened volatility during election periods. The effects of US elections impact the markets more than those of any other country because of the reserve currency status of the dollar. In this article, FTD Limited shares insights on the effects of US presidential elections on the dollar index from different angles.

General Fiscal Policy Views of Political Parties

Republican Fiscal Policy View

Tax Policy: Republicans usually prefer lower taxes to boost economic growth and foreign investment, which can strengthen the dollar. However, tax cuts also have a negative effect on the budget, so if the tax cuts are too large, they can increase debt, inflation, and depreciation of the dollar.

Spending Policy: Republicans prefer smaller government with low taxes and low spending. Reduced spending will decrease the budget deficit and inflation, boosting the value of the dollar if it is done at a pace that does not slow the economy too much.

Regulation: Republicans favor deregulation, arguing that less government oversight allows businesses to grow, operate efficiently, and innovate more freely. This could enhance the productivity of businesses, boost growth, and attract foreign investment, thus boosting the dollar’s value. However, if done excessively, it can destabilize the economic environment.

Democrat Fiscal Policy View

Tax Policy: Democrats typically support progressive taxation, where higher income individuals and corporations pay higher taxes. In this way, income inequality should decrease. In the short term, it can have a negative effect on the dollar because high taxes might discourage businesses, both foreign and local, and individuals from investing. However, if done in a smaller and efficient way, it can reduce inequality and boost overall consumption in the long run, increasing dollar demand.

Spending Policy: Democrats advocate for a bigger government with more spending on social programs such as healthcare, education, and infrastructure. The idea is that social spending will provide a safety net for the disadvantaged, and infrastructure will boost business, thereby growing the overall economy. Increased spending will boost the dollar index in the short term, but if it goes overboard, it will damage the budget, increase the deficit and inflation, and depreciate the dollar.

Regulation: Democrats usually support more regulation to protect consumers, workers, and the economic environment. This can create a stable environment for long-term investments, but in excess, it can cause investors to look elsewhere. In the short term, regulations might increase business costs and reduce short-term foreign investment, which can cause the dollar to lose value.

Conclusion on Fiscal View Effect

Both parties have views that can affect the dollar positively and negatively, but because of the more business-friendly attitude, the Republican view tends to be seen as more dollar positive. However, in the long term, tax and regulation policies might damage some parts of the economy. Similarly, the Democrat view on fiscal policy might frighten investors in the short term and negatively affect the dollar, but it can create a positive environment in the long term if spending and the budget deficit are kept in check.

Averages

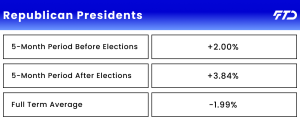

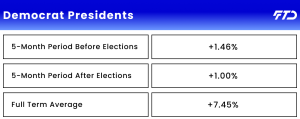

Although there are different circumstances in every president’s term, the long-term averages might give some ideas about what to expect from either a Republican or a Democrat president. We use five months for calculation because it will be the beginning of the second half of the year with enough time to price in the election expectations. There are six terms for both Democrat and Republican rule during the calculation period (since 1975), so the averages might give a healthy idea if there is any meaningful correlation between the elections and the dollar index.

Both before and after the election, the dollar seems to be on the winning side. Before the elections the dollar index gains 1.73% on average for the 5-month period. After the election the average rose to 2.42%.

The sentiment that Republican fiscal views will strengthen the dollar is clearly visible when looking at the averages. Both before and after the election, the dollar index performed much better relative to Democratic presidential elections. However, for the full term, the effect reversed significantly. Some special cases are worth mentioning because of their huge impact on the averages.

The most impactful one is the first and second terms of Ronald Reagan. In his first term, with Reaganomics, the dollar index gained more than 59%. However, in the second term, it lost most of those gains. George W. Bush’s term also affected the averages greatly. During his first term, the dollar index lost a fourth of its value, impacted by the dot-com bubble burst and the 9/11 attacks. Finally, the COVID-19 effects in the final year of Trump’s presidency caused significant, though moderately short-term, damage to the dollar index.

The sentiment about Democratic fiscal views is more neutral. Increased government spending is expected to stimulate the economy, but the possible debt increase that comes with it should negatively affect the value of the dollar. In the periods prior to and after the election, the dollar gains are relatively modest. However, the average full-term gains of Democratic presidents are significantly higher than those of Republican presidents. Of course, some special cases significantly affect the averages during Democratic presidential terms as well.

During Jimmy Carter’s presidency, the energy crisis hit the markets. During Bill Clinton’s term, increased trade and economic expansion caused the dollar to gain significant value. In his second term alone, the dollar index rose more than 30%. Obama came to power during the 2008 crisis. With low rates and QE, the dollar index fell nearly 5% during Obama’s first term, but this effect reversed in his second term, resulting in a gain of over 20%.

Biden vs. Trump

In this part, we compare Biden and Trump’s terms, focusing only on their impact on the dollar index not the whole economy.

Trump won the election in 2016 when the dollar index was just below 98. During his presidency, the dollar index was relatively steady, but after COVID-19 hit the markets, the dollar fell sharply towards the end of his presidency. The stimulus programs and the FED’s emergency QE were the main reasons for that move. Until the stimulus program, US public debt increased by more than 18% during Trump’s term, but by the end of his term, this percentage rose to over 37%. During this time, the US 10-year bond yield average was 2.11%.

When Biden took office, COVID-19 was in full effect, but with the early arrival of vaccines and both Trump’s and Biden’s huge stimulus packages, the economy recovered quickly. When Biden was elected, the dollar index was at 93.500. After falling below 90, the dollar recovered with the economy and rose as high as 114. From Biden’s election to date, US public debt has risen more than 28%, and during this time, the 10-year bond yield average was 2.91%.

Burc Oran, Senior Market Research Specialist at FTD Limited, commented on the potential election outcomes:

“US debt is rising faster, which is negative for the dollar over the long term. Democrats and Republicans have different fiscal views on spending and taxation. Over the long term, the changing presidencies have given both ideas a chance, providing some stability to the fiscal path. However, the path does not seem sustainable, and so far, neither party has done enough to change the trajectory.

On average, sentiment for the dollar path is more positive prior to and after Republican presidents, but over the full term, Democratic president terms were much better for the dollar on average. However, it may not be enough to make a safe deduction because many special occasions have occurred during different presidents’ terms.”

About FTD Limited

FTD Limited, a multi-asset brokerage firm established in 2017, offers a trading platform with access to various asset classes (FX, equities, futures, indices) on major global exchanges. Their technology prioritizes fast and efficient execution, clearing, and liquidity solutions. They cater to institutional investors, high net worth individuals, and professional clients with a global presence in the Middle East and Asia.

For more information, please contact: info@ftdsystem.com

Media Info:

Website: https://ftdsystem.com/

Info: info@ftdsystem.com

Address: Address: 219 N Brown Ave, Suite B Orlando, FL 32801, United States